- #Site for nj tax refund status 2017 how to#

- #Site for nj tax refund status 2017 plus#

- #Site for nj tax refund status 2017 tv#

To receive a notification when your refund is issued and other electronic communications about your income tax refund, select both options.

#Site for nj tax refund status 2017 tv#

Videos you watch may be added to the TV's watch history and influence TV recommendations. If playback doesn't begin shortly, try restarting your device. However, you can respond to most letters online, quickly and easily.

#Site for nj tax refund status 2017 how to#

Please refer to the section titled “Repayments” in the IRS Publication 525 Taxable and Nontaxable Income for guidance on how to report overpayments/returned funds. If you were overpaid benefits, your 1099-G will still reflect, per federal law, the amount of funds paid to you, regardless of any funds you have returned.This does not include any taxes you chose to have withheld.

#Site for nj tax refund status 2017 plus#

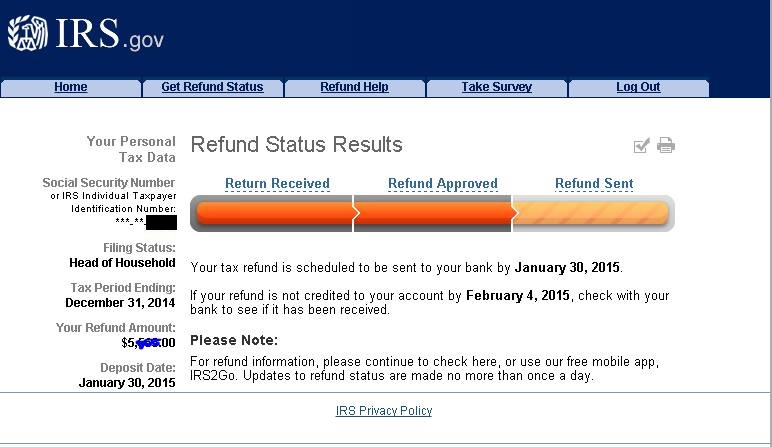

For example: If you received 35 weeks of the maximum benefits ($713 x 35) in 2020, plus FPUC (17 weeks x $600), plus FEMA/LWA (6 weeks x $300), your Form 1099-G will show the sum of all of these payments ($36,955).You are responsible for paying any required federal taxes on any unemployment compensation payments you received in 2020, including these new COVID-19 related programs, in 2020. The option to withhold taxes was not available for the supplemental $600 and $300 Federal Pandemic Unemployment Compensation (FPUC) or $300 FEMA Lost Wages Assistance payments.Depending on your tax bracket, you could owe additional taxes and are responsible for declaring the income. If you received Unemployment Insurance, Pandemic Unemployment Assistance (PUA), Pandemic Emergency Unemployment Compensation (PEUC) or Extended Benefits (EB), you may have chosen to withhold 10% of your benefits for tax purposes.Find your state and click on the link to go directly to your state’s refund status tool. Wheres my state refund 2017 It’s easy to check the status of your state tax refund using the online refund status tools on each state’s Web site. Please report your case of suspected fraud as soon as possible online or by calling our fraud hotline at 60. For general information about your state, click your state in the State line. Identity theft/fraud alert: If you receive a 1099-G but did not receive Unemployment Insurance compensation payments in 2020, you may be the victim of identity theft. This information is also sent to the IRS. Information for Working Parents and CaregiversĪfter each calendar year during which you get Unemployment Insurance benefits, we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld.with no expectation of significant financial return (pro bono service). Federal and State Extended Unemployment Benefits Ethical decision making in a given situation must apply the informed judgment of.

0 kommentar(er)

0 kommentar(er)